The Layered Approach to Measuring Out-of-Home Advertising

Okay, buckle up. This one is going to be a deep dive into Measurement.

From tip to tail, we’re going to set a foundation for ongoing conversations about quantifying the impact of OOH. And here’s the thing, it’s not going to be one size fits all. It’s going to be a little bit bespoke, but it’s going to establish a framework and outline how to set up a successful measurement system that makes sense.

To qualify this a little further, what we’re going to discuss here is really probably the first time these concepts have been laid out in one place, with a methodology applied to them, so I hope that this brings you tremendous value.

The best way I know how to talk about measurement is with a story, so let me take you back to the summer of 2019. I was working at Adams Outdoor in Eastern Pennsylvania selling a white-labeled mobile advertising product that we’d pair with billboards as a retargeting tactic that we called Smart Billboards. Advertisers loved it because they got the big market reach with their billboards, which unlocked efficiency in their mobile display ad campaigns. Consistently, when local advertisers ran the two tactics together, the click-thru rates for the mobile display ads were 30-50% higher.

It made sense. The billboards created credibility and that increased the likelihood someone was willing to click on one of the little picture ads served to them on their phones. We knew they had seen the billboard for the same advertiser and voila. After that came a nonprofit that decided NOT to add the mobile display retargeting but DID give me access to their Google Analytics.

They ran on a network of digital bulletins and posters throughout the market and one day I decided to check their website traffic. I was blown away. New visitors to the site were up, website donations were up, and the average SIZE of donations was up. And not up in just a little way, up 40, 50, 60% in some metrics. I immediately called the marketing director who informed me that this was their slow time of the year and that they only did the billboards because they had a little extra budget and wanted to do something nice to recognize the community.

I sometimes kid that I’m a recovering digital marketer but I’d never seen anything like this. I’d never seen a single tactic act like rocket fuel this way. A few weeks later, I switched over to the business development side to sell billboards. I split-tested two different creatives for an Orthodontist on that same network of digital billboards to determine which creative was more effective before ordering $10,000 in static bulletin production. One creative was clearly better and drove almost 40% MORE website traffic.

This was all while I was still at Adams and before pioneering some of the really exciting stuff at OneScreen like how two-sided marketplaces often see some of the highest rates of new website user traffic of all advertisers on OOH yet they don’t enjoy the same conversion rate increases that B2B and B2C brands do when they add OOH to the mix. I’ve seen an online retailer that sells high-end puppies take a bottom 5 performing market and turn it into a top 3 market in less than 30 days through the addition of OOH and Radio.

(They also ran markets with ONLY radio, chose control markets for all scenarios, and the OOH + Radio markets outperformed all other media mixes.)

I’ve seen cannabis brands optimize creative based on the deterministic, pixel-based measurement and how direct-placement OOH campaigns drive exposed visitation rates comparable to the click thru rates of search engine marketing. What does that mean and why does it matter?

The exposed visitation rate for OOH is the equivalent of click thru rate for digital ads online.

It’s the size of the captured audience who was exposed to the ad relative to the number of those people who went back to the website of the advertiser. In online terms, that’s like click-thru rate, which is the number of times an ad is served relative to the number of times it is clicked.

Search engine marketing has long been considered one of the highest-quality paid traffic sources a brand could use. It’s the redirection of high-intent search behavior where someone is sitting down and typing in the thing they are looking for. Serve them a relevant ad and bam - you’re in consideration.

On average, those search engine marketing click-thru rates are in the 2-3% range, meaning for every 100 searches, they’re getting 2 or 3 people to click on an ad and go to their site. When you measure exposed visitation for OOH on a direct placement campaign, the exposed visitation rates are in that same 2-3% range. That’s crazy.

And when you consider that the google search ads are based on someone actually looking for you vs the OOH campaign being generally audience or interest-based, the value of that visitor who is not only intrigued and interested by your brand but is also that eager to seek you out after seeing you in their real-world journey.

That’s an incredibly valuable visitor and that’s an incredibly powerful story to be able to tell an advertiser, but it may or may not be the right one to tell depending on the scenario and that’s what I see most frequently wrong about OOH measurement - that publishers, agencies, whoever is just saying “here’s what we measured, look how awesome it did!” vs asking the question: what do you want to measure?

Measurement really starts during the client needs analysis.

It starts with asking great questions, specifically, about the business’s unit economics. It’s something that I rarely see anyone do and I don’t know if it’s because of a lack of education about the types of questions to ask or appreciating the importance of understanding your advertiser’s business intimately, but it’s the lowest hanging fruit for telling a better measurement story.

Here’s what I see most often: 'This is what we measured, look at how well it worked.'

And then confusion for everyone when the brand sees no value and doesn’t renew. Or worse yet, just ghosts you outright.

Worse though is the cousin of “here’s what we measured” which is the “basically we are the only reason you’re even in business” measurement report. Psst, let me read you in, when you take all of the credit, as if the business would cease to exist if they didn’t include your tactic, you lose all credibility.

I was recently at a meeting with a popular place-based media network and their team all but claimed credit for millions of visitors in foot traffic lift for a national chain. No pre-covid comparison, no relative basis or control markets, and it got even worse when we started to ask questions about the methodology and how impressions were calculated. You see, when you take all the credit, you better be prepared to back it up and have an absolute lockdown case.

Instead, I recommend taking a holistic approach to measurement and I’ve found that it’s really what serious advertisers are looking for. Savvy marketers know that no measurement is perfect, rather they understand that they need to analyze multiple signals, with variable values, to create a directionally accurate picture of the marketing performance. These are the types of brands that want you to ask them about their business, about how they make money, about whether or not supply chain issues are a challenge to their business because when you understand those elements of their business it allows you to do two things:

- It allows you to prescribe a measurement methodology that makes sense for the campaign objective, advertiser, long-term success

- Quantify the value of what you’re able to measure (this is the really important part)

We’ve all seen the sales lift stat - “Brand X saw a 73% sales lift”

Okay, but what’s that worth? What does that mean? Does it mean that they were selling 100 and now are selling 173? If so, what is the incremental value of those 73 new sales?

Does it offset the advertising expense? If not, is that a strategic choice the brand is willing to accept? To acquire customers at a loss with offline media because it’s LESS of a loss than their online tactics?

Speaking of online tactics - how does adding OOH or other offline media affect the performance of your online tactics? Maybe you’ve heard of the ‘1 + 1 = 3’ effect of OOH but it’s actually quantifiable, you just have to know where to look.

Is your online conversion rate better? Are email open rates higher? SMS campaigns performing better in the market with OOH than in other markets? Measuring OOH in a vacuum is a complete disservice to our advertisers and to the channel so get in the weeds on this stuff because I’ll say it again - it’s not one size fits all. You can approach it that way, sure, but if you’re looking for brands that will continue to invest confidently and scale, then they’re usually looking for a partner who is invested in doing that with them and that is going to require going beyond your cookie cutter approach.

And how about brand lift surveys? That’s potentially the greatest disserve to anyone, ever. Not because they’re not valuable, but because no one seems to go the additional step of quantifying the impact.

That’s the theme of the episode I guess, quantifying the impact.

Did you know that the #1 brand in a category is typically 3X more profitable than the #3 company in the same category? But the #2 company? Well, they’re half as profitable as the #3, so how much is it costing your business to get stuck in the middle?

How valuable does a brand lift study become when you find out that the primary driver of top-of-mind awareness is the frequency of purchase? Pretty darn valuable and we’re doing advertisers a disservice by not extending the conversation beyond “here’s what we can measure”.

Okay, that’s a lot of me waxing poetic for effect, so let’s get tactical.

Here’s how to get started.

Start by asking - what do you want to measure?

Most advertisers are going to fall into one of two buckets - bricks or clicks, that is, a brick-and-mortar brand that wants to drive foot traffic or an online brand that wants to drive website traffic. Bricks or clicks.

Next, ask how they measure their other marketing against those objectives.

This step is essential, it’s the echo. Echo back what they told you to make sure you understand and that they know you understand. If you don’t understand, ask more questions so that you do.

If you do these couple of things, you’ll already be ahead of the majority of folks who just flash open their trench coat like “here’s what we can measure - ha!”.

If you ask these types of questions, you’ll start to understand how the tools in your toolbox may apply to the use case. OOH is a full-funnel medium and thus, the format matters. Creative messaging should match the format and its place in the funnel. Large format roadside? Let that be your brand’s anchor message. It’s your authority and credibility builder. But the place-based digital kiosk outside of a Whole Foods? That’s a middle funnel tactic and placement, start layering in that consideration messaging.

You may have heard about Google’s four key micro-moments, moments in the modern buyer’s journey where brands can win hearts and minds. These are moments when we want to know something, go somewhere, do something, or buy something. It’s looking for a recipe or signing up for a cooking class, it’s going to a food truck festival, or finally making reservations for that great new spot in town.

The messaging for these moments are top consideration and is applicable to any level of the funnel, but becomes particularly important in those 1:few and 1:1 moments in the real-world buyer’s journey.

Consider the context; the time and the place where the ad is being experienced.

Are the time and place likely to yield conversion? Is it even appropriate to be making an offer? Or is it more likely to be an engaging branding opportunity and a thoughtful moment along the journey?

OOH Measurement is kind of like a layer cake in that way.

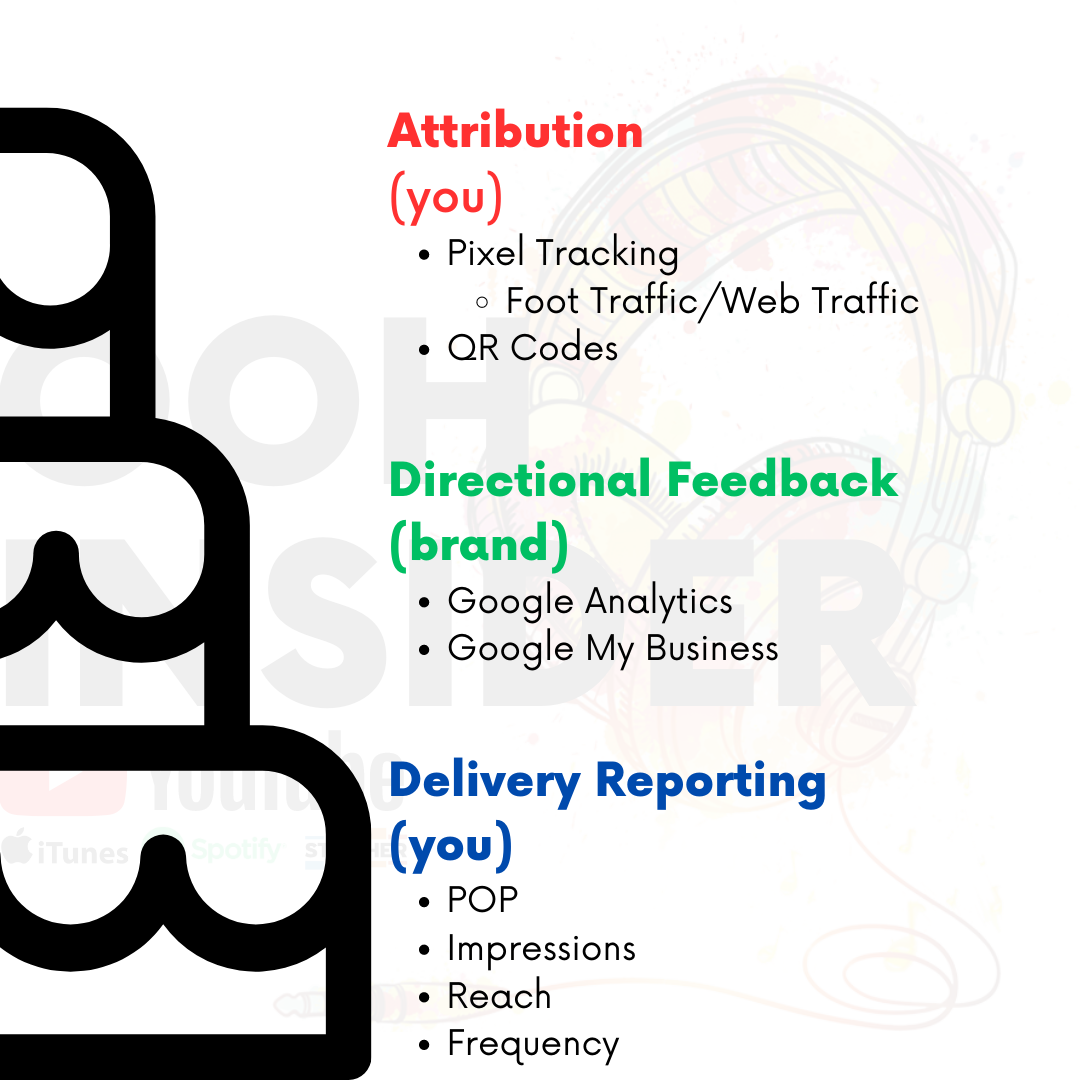

On the bottom layer, you have the block and tackle stuff, proof of performance photos to make sure your ads are up during the times and dates you expected them to be, and then from there, reach, frequency, and impressions. This gives you a base to build upon - knowing what was delivered and when it was delivered.

From there, is a middle layer. That middle layer is really the stuff that the brand knows best. Their own internal sources of truth. For some this may be Google Analytics, for others it may be Google My Business, depending on whether their objective is web traffic or foot traffic. For others, it may be some custom dashboard that analyzes all of their media against sales and lead volume. I’ve even worked with brands that were solely interested in analyzing their store sales volume of specific SKUs in the markets they’re advertising in, in comparison to some other segment of their retail footprint.

This is the directional feedback that is our responsibility to educate brands on and be partners in. Educating on how to look for lifts in phone call volume, requests for directions, or how to parse out new user acquisition and improved conversion rates in the markets where OOH is running. The middle layer is that great directional feedback from the brand’s own data.

And lastly, if you have those two things all firing, then you can add attribution, the deterministic elements.

Deterministic measurements are things like pixels and potentially even QR codes in the right application. We could do an entire episode on pixels alone, but the basic premise is to capture an audience exposed to an OOH campaign, place a pixel on the advertiser’s website, and observe for people who see the ad and come back to the site. You can also use this to measure specific behaviors on the website, like purchase activity, and even inside of mobile apps, if you’re a brand with some sort of app objective, like downloads or usage. You can also use that same exposed audience to measure against a brick-and-mortar point of interest for foot traffic attribution, so this is really the “last click” of OOH if you will.

It can be really useful for comparing the performance of specific networks and formats, but can also be misleading if used to measure the performance of a single billboard because it is really looking at the last ad exposure vs the holistic exposure to a campaign.

QR is a conversion mechanism

You’ve also got QR codes which seem to consistently come up and personally, I don’t think they’re a good way to measure OOH performance. I do think they’re a GREAT way to shorten the buyer’s journey and connect the audience to the ad. I’ve seen QR perform extremely well as a tactical conversion mechanism with a general consumer product and a great offer in 1:1 settings like rideshare TV and on point-of-sale screens in convenience stores and we’ve all seen huge QR code drone shows that go viral and get tons of buzz just for the awe factor. QR is a conversion mechanism, that’s all, it’s NOT a measure of whether OOH works, though you could say it is a measure of whether or not your brand is interesting/relevant more than anything.

This feedback can be factored into your measurement layer cake and considered as a valuable data point with lots of insight. For QR Codes, I really like Flowcode because they are able to actually attribute things like website sales to the visitors who scan the QR code, which is not something previously available.

Above all, the most important part of the measurement conversation is being able to quantify the impact and that’s less about the tools at your disposal than it is about asking great questions during discovery and being a partner in understanding how the advertiser’s business makes money and what they care about measuring.

Live hungry.

Stay full

- Tim